I can’t believe I’m saying this, but 2025 is almost a wrap. This is my last blog of the year (unless something really wild happens, which after 2025 thus far it wouldn’t surprise me), and all eyes are turning to 2026.

I wanted to think back over the course of 2025 to gain some perspective on a pretty wild year in the markets, plus to give some critical review of the blogs I sent throughout the year. As for 2025, it started out HOT with the markets hitting new highs in January and February. It truly felt (to me, and based on sentiment) that people were feeling a little too confident. Then, starting the last week of February, through early April, the market fell roughly 20%. That’s one way to curb overly optimistic sentiment, and I’d say it did that pretty well. Obviously, everyone was feeling pretty bad (including me) back in late March/early April (especially after the “Liberation Day” tariff fiasco). But, that’s exactly when clients need us to provide some perspective and perhaps even some optimism. Here’s a blurb from my blog on April 8th, which was (luckily) almost exactly at the bottom of the sell-off:

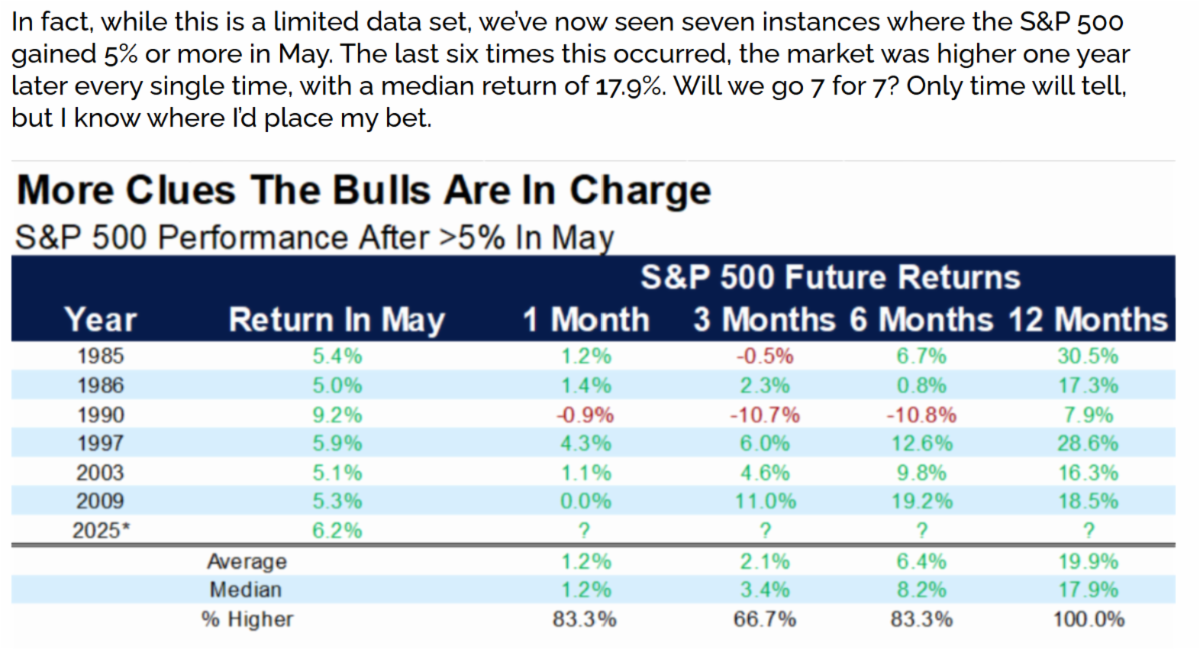

I’d say that one worked out pretty well! But, we weren’t out of the woods just yet. We kept hearing silly terms such as “dead cat bounce” and “bear market rally” from all of the pundits out there. But, the probability of markets going higher just kept, well, going higher. See below from the June 3rd blog:

Once again, playing the probabilities worked out well for investors. And, while the 12-month story isn’t fully written, I think there’s a pretty good chance of 7 for 7 on this data set. But, not everything went as expected in 2025. See below when we suggested market weakness was nigh and to expect some short-term declines. I’m actually happy to say this one from August 5th didn’t work out 😊!

As I write this, I can say it’s been a pretty darn good year for almost every asset market (stocks, bonds, gold, crypto, etc.). I doubt anything will change that in the next couple of weeks. Remember, the “Santa Claus Rally” is typically reliable for gains into year-end. But, 2025 is mostly water under the bridge at this point. So, what do I expect for 2026? Well, I’m not going to make any wild predictions because I think that is a useless exercise, but you better believe that I’ve looked at what history suggests. That’s what I’ll rely on for now. Of course, I’ll be updating my thoughts once we get into the new year.

- No surprise, but 2026 will probably be a letdown after the big gains in 2023, 2024, and 2025. Odds just don’t favor another double-digit return year.

- Second year of a presidential cycle tends to be weak in the first half. So, yeah, I’d expect a weak first half of the year in 2026.

- That all being said, we are still in the middle of a major “industrial” revolution, as the Artificial Intelligence wave will continue to drive innovation, productivity, margin expansion, and earnings increases likely for years to come. Don’t underestimate the power of this seismic shift we have been witnessing for nearly three years now.

- No, there isn’t a bubble (yet). Doesn’t mean we can’t reach that level of investor exuberance. But, we haven’t reached any type of extremes in investor sentiment (frankly, it is mostly negative). And, until we reach that point, this strong bull market still has legs.

- Actually, the AI trade has been cooling off quite a bit over the last few months, but as in any healthy bull market, investors have just begun to rotate into less expensive areas of the market. Market rotation is the lifeblood of a healthy bull market.

- Here’s a friendly reminder to STAY diversified. Don’t have all of your assets in the AI/Technology trade. I assure you that we will diversify and manage any assets entrusted to us responsibly.

Sorry, this was a bit longer than normal, but heck, we are wrapping up a full year, so there is a lot to think about. But, as I sign off on the 2025 calendar year, I want to AGAIN thank each of you for the confidence you place in our team on a daily basis. We take that responsibility very seriously (although we like to have some fun along the way). And, most importantly, make sure to slow down over the holidays and reflect back on the year. Cherish the time you have with friends and family. And, finally, I hope everyone has a Merry Christmas, Happy Holidays, and a wonderful New Year!

Past performance is no guarantee of future results. For illustrative purposes only and not indicative of any actual investment. The S&P 500 Index is an unmanaged index of 500 companies used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. These returns were the result of certain market factors and events which may not be repeated in the future. The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person.

Tracking: 838086-01-01