Well, the markets certainly finished off 2023 with a bang! Those year-end statements were a pleasant surprise for most investors. I think we all needed that, and if you paid much attention through 2023, you may have noticed that the majority of the total returns came in the last 2 months of the year. It certainly is a good reminder that market gains can come in bunches, in fact, just missing several of the best days of the year can significantly impact performance. In other words, stick to the plan.

Now, as we’ve finished off January 2024, we are being inundated with “new all-time high” headlines. And yes, some indexes have reached new highs for the first time in over 2 years. But, there are still several asset classes that are well off their all-time highs: The small cap “Russell 2000,” the US bond market and even emerging markets are still mired in a long slump. Most diversified portfolios have some exposure to these areas. Regardless, these are good developments, and “new highs” are nothing to be afraid of. Let’s face it, the markets would be where they were 50 years ago if “new highs” were a ceiling.

But, while the Economy continues to baffle most experts by (so far) staving off the effects of a massive interest rate hiking cycle and damaging inflation boom, and the “animal spirits” that often accompany market rallies and new highs have the investing public abuzz, we just want to take the opportunity to suggest that discipline is a 2 way street. In other words, investors should stick it out when things get rough, but they should also remain disciplined when things feel really good. So, don’t change your investment plan just because markets are up or down. And even more importantly, now is not the time to look for quick gains by throwing money at the hot trends that have been driving some markets higher (Anyone heard of Artificial Intelligence, aka AI of late?).

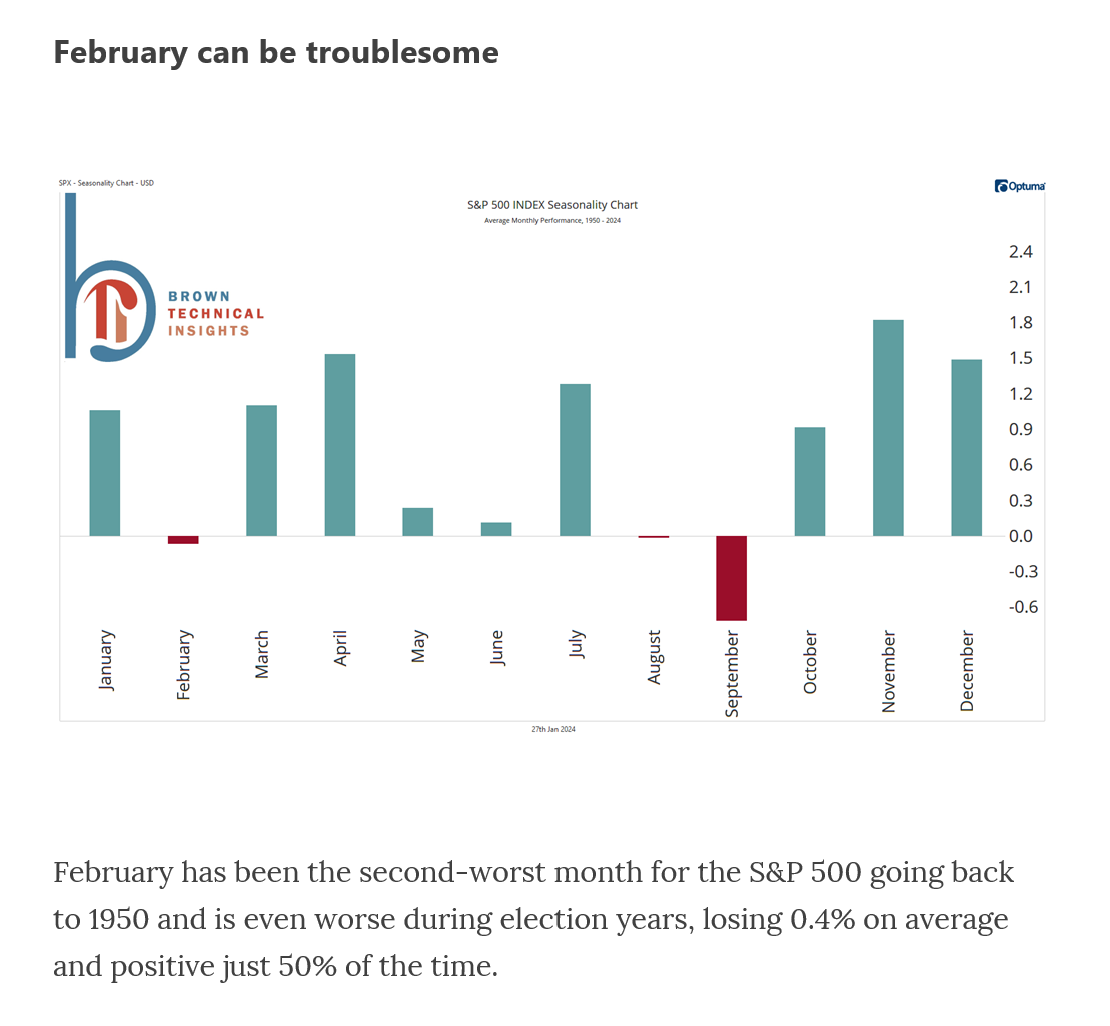

While we are mostly optimistic for markets in 2024, especially for those areas that lagged in 2023, February has historically been a difficult month for investors. In fact, in the chart below, courtesy of Brown Technical Insights*, we can see that February is the 2nd worst month of the year on average, and the only month other than September that averages a negative return (albeit a small one). And, that trend is even worse historically in election years.

In fact, overall, the 1st quarter in an election year tends to be pretty challenging and generally flat overall. Don’t get me wrong, we aren’t sounding the alarm by any stretch. We would just suggest being a tad more cautious in the month or two ahead, as we are likely to see lower prices at some point during that stretch. But, the goods news is that election years tend to be strong, with the 4th quarter providing most of the returns.

So, don’t be surprised by a little weakness in the coming month or two, but history suggests more good things are in store in 2024!

*Brown Technical Insights is not affiliated with or endorsed by LPL Financial or Linea Private Wealth Management.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Tracking #539047