Ah, one of my favorite weeks of the year has arrived. Spring has sprung, warmer weather is here to stay, and all attention will be on the Masters coverage from just down the road in Augusta. If you are a golfer (or golf fan, or both) like me, this is possibly the best week of the year!

Unfortunately, this may not be my most fond Masters week as markets have been absolutely clubbed (pun intended) since the Trump tariff announcement (Liberation Day?) last Wednesday after the market close. Obviously, as I’ve communicated, up until then, the market gyrations were perfectly normal and somewhat anticipated. I’d still suggest that was largely about the market being overdue for a correction. But, the calculus certainly changed last week as markets were completely caught offside by the announcements (we knew they were coming, just not to that extent), and suffice to say, the markets adjusted pretty swiftly. There’s no sugar-coating it. This has been bad. I’m not going to downplay it, even though I like keeping these blogs fairly light-hearted.

But, we’ve been through bad periods before (too many for my liking). And, we can look back at 2 such periods just within the last 5 years! Obviously, the Covid pandemic caused a 35%+ pullback in March/April 2020. We also saw a 25%+ pullback during the inflation-driven bear market of 2022. And, while I’m not suggesting the reasons are the same, the market damage and ultimately the recovery playbook will be similar. So, here are a few thoughts on how to get through this period…

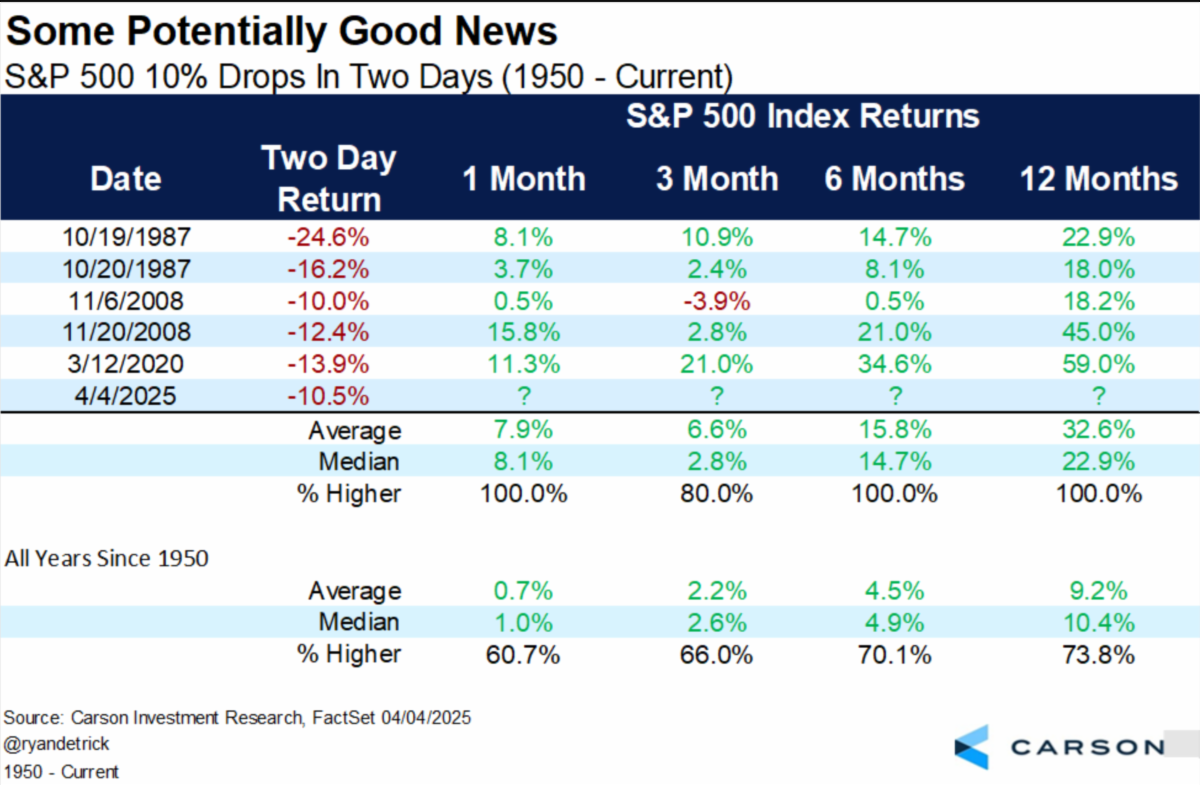

First of all, a 10%+ drop in a 2-day period is pretty rare (such as Thu/Fri last week), but we’ve seen it happen (now) 6 times since 1950. And, while there are no guarantees in life (or investing), the markets have been substantially higher 6 and 12 months later in every instance. Will we be 6 for 6? Only time will tell, but I like those odds. Thanks again to Ryan Detrick with Carson Investment Research for this great observation…

That’s great data, but it is very hard to think out a year from now when we are in the middle of a noisy and volatile period like we are now, so here are a few things to consider…

- None of us knows when this will end or recover. NONE of us. Anyone who says otherwise is probably trying to sell you something.

- Unless you need access to ALL of your investments in the next year, then this shouldn’t matter (yeah, I know it does). Most likely, even if you are living off of your investments in retirement, you have cash, bonds, dividends, etc. that will provide for your liquidity needs for some period of time. The key is to NOT SELL or not be FORCED to sell during corrections (bear markets?) like these.

- If you are in the desirable position of having excess cash right now, consider a plan to get that money put to work in the coming weeks (see graphic above).

- Don’t make emotional decisions. They never work out well (at least in finance). Unless your plan or situation has changed, then don’t change your investment strategy.

- Lastly, there is nothing good to be had from looking at your account daily, or your stock list or the financial news (get ready for lots of “markets in turmoil” specials on TV). Just don’t do it. I promise you, it’ll only make you anxious and increase the odds of a knee-jerk reaction. Instead, listen to some music, get some exercise, spend a little more time with your friends/family (it’s Spring Break for many of our kids). You won’t regret it.

I have no idea how the short-term is going to play out. I really don’t. We could be up 10% in the next week or down another 10%. Neither would greatly surprise me. But, I DO know that I can’t time any of it. And, in many (if not most) cases, when you are just unsure of the best thing to do, you just sit tight. Largely, that’s what we’ll do here in the very short-term. We’ll let things settle down a little, at least until we have more clarity. Once we do, we’ll communicate and advise accordingly.

Which brings me to my final point about Masters week. Trust me, we get rattled during times like this too. The weight of all the trust that our valuable clients place in us on a daily basis is humbling and terrifying. I have to practice what I preach, which is why I’ll be reminding myself to really soak in the great week of coverage at The Masters. Of course, I’ll be paying attention to markets, trading accounts as needed, fielding client concerns and anything else that pops up, but I’m really going to focus on enjoying what is otherwise a great time to be in Georgia. I’d suggest everyone does the same.

Until next time (which could be very soon)….

Past performance is no guarantee of future results. For illustrative purposes only and not indicative of any actual investment. The S&P 500 Index is an unmanaged index of 500 companies used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. These returns were the result of certain market factors and events which may not be repeated in the future. The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. Tracking: 721978-01-01