There is really no parsing words for 2022. It has been a very tough year for investors. As of the end of September, all of the major market indexes are down 20% or greater. To make matters worse, the traditionally “safe” bond market is down by more than 13%. Heck, even Gold – a very traditional safe haven and hedge against inflation is down nearly double digits for the year. There has been nowhere to hide, except cash. Or, if you are a real risk taker, oil stocks have done well after nearly a decade of underperformance.

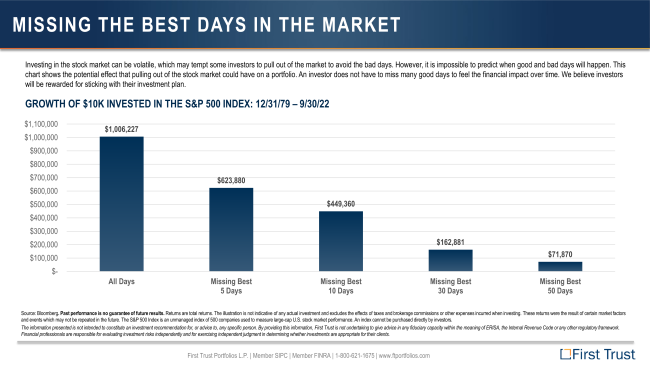

Still, as a rather snarky saying in the investment industry goes: “The Market Timing Hall of Fame is empty.” The main reason is that you need to make two correct decisions. The first is the easy one – when to get out. It takes zero discipline and actually feels good at first. The second is WAY harder – when to get back in. That takes enormous discipline and fortitude. Even though there is no real Market Timing Hall of Fame, it would be empty if there was. The chart (courtesy of First Trust) below is the difference in performance by just missing the best 5, 10, 30, and 50 days of the S&P500 since 1979. It’s big.

The bottom line is that while it can be very tempting to “get out” during these rough stretches, it has historically been a terrible decision. The best defense against a bear market is having the right portfolio for your personal situation and keeping enough “emergency cash” available to avoid surprise withdrawals when life throws you a curveball.

While we still expect markets to improve throughout the end of the year, we can’t guarantee that. The future is always uncertain. We are confident however that the best course of action is to stick to your plan and ride out the storm.

If you’d like to discuss this, of course, give us a call.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested in to directly.

[i] According to First Trust: S & P 500 Index. Although stock market returns fluctuate significantly, since 1926, the S & P Index produced positive returns 74% of the time, with an average of 21.3% tracking # 381889-1