Well, just like that, the concerns over the tariff wars, real wars, recession fears, and every other scary thing in the world have magically gone away, and just a day or two ago, the S&P 500 hit a fresh all-time high. Needless to say, it has been quite a year so far (and pretty confusing, honestly).

However, with all of the headlines now talking about new highs, I’m starting to (and will continue to) get questions about whether it is wise to put new money to work or not. Many feel that buying at all-time highs is a sucker’s bet. And, I totally understand that. I mean, one of the most widely used investment concepts is “buy low and sell high.” And, while that adage is technically true, that’s not really how the market works. What it should REALLY say is “buy now, sell higher.” That practice has worked forever, with the only real variable being how long it takes to go higher. That leads me to the main point of today’s blog: All-time highs are NOT scary.

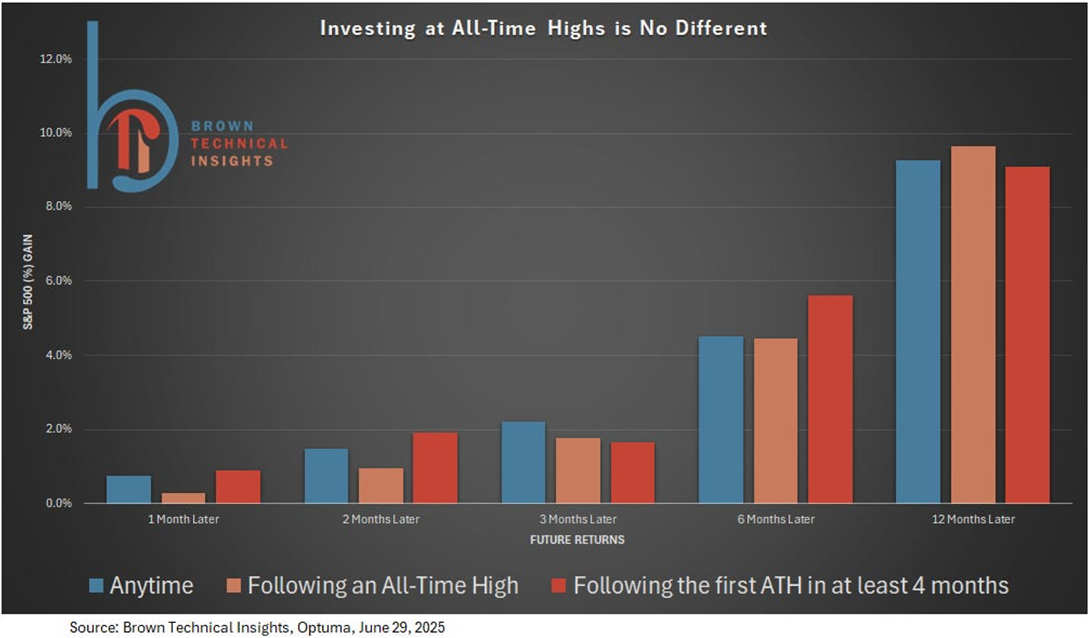

Take a look at this excellent info below from Scott Brown at Brown Technical Insights:

Feel free to dig into the details here, but the simple point is that there is virtually NO difference in buying after an all-time high vs. just buying at any other random time. In fact, 6 and 12 months later, history has shown that you’d actually be slightly better off buying after new highs. I bet most people find this rather hard to believe, but the data is the data.

So, whether you are looking to put cash to work or are simply wondering whether to take profits here, history shows that forward returns have been strong from these levels.

Let me add another data point in favor of the bulls:

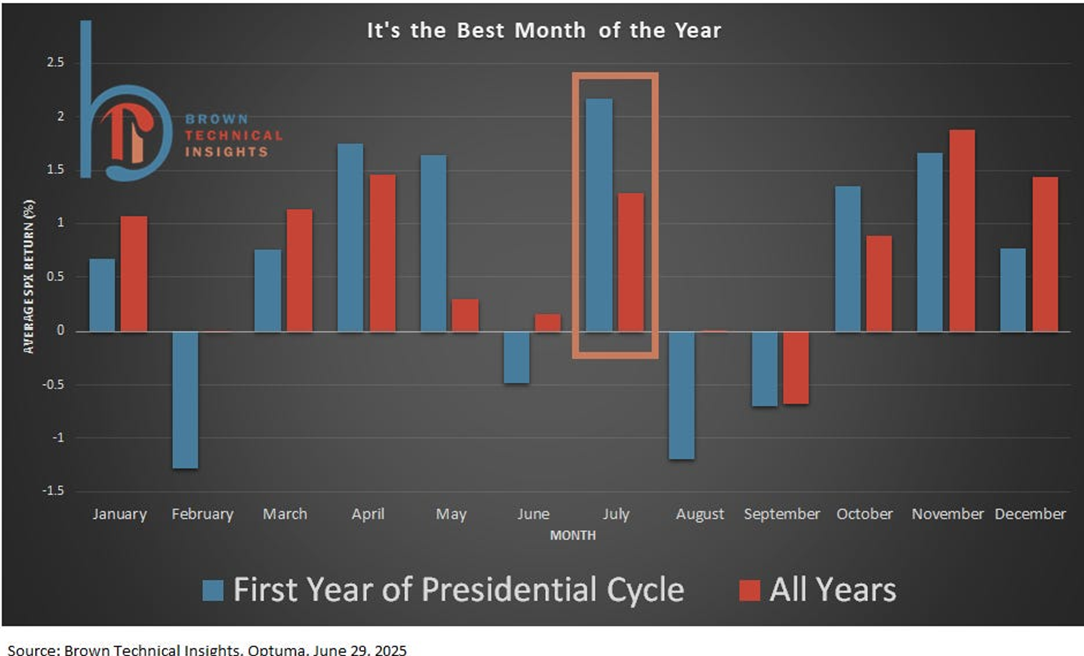

In last month’s blog, I suggested June could be a weak month based on historical trends.

Let me be the first to point out that I WAS WRONG!!! June was a great month for stocks. You’ll notice I also said that no one can or should try to time this stuff. But, the most important part of this paragraph is the last sentence – “July is the best month of the year historically” (in the 1st year of a Presidential cycle).

Well, here we are. In the same Presidential cycle data, we can see that July has been very strong historically.

Now, I just pointed out that June didn’t go quite as (historically) expected, so it is very possible that July throws us a curveball as well. Again, we aren’t going to try to time anything. But, combined with the “all-time highs” data above, probabilities just continue to suggest more upside from here, at least over the next 6–12 months. Of course, August and September are not great for the first year of a President’s administration, so as always, keep your near-term expectations in check.

I hope this information is helpful. Feel free to forward to friends and family if you think they may benefit from reading it. More importantly, I hope you have a wonderful 4th of July holiday weekend. What a great time of year! But, enjoy it b/c it is FLYING by.

Until next time…

Past performance is no guarantee of future results. For illustrative purposes only and not indicative of any actual investment. The S&P 500 Index is an unmanaged index of 500 companies used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. These returns were the result of certain market factors and events which may not be repeated in the future. The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. Tracking: 763320-01-01