I’ve been in this business for a long time (it’s a bit unsettling how long, but that’s another story), and I have vivid memories of investor behavior during major bull markets of the past. In 1996, Alan Greenspan, then the Fed Chairman, warned markets against “irrational exuberance.” Yet, the market enjoyed three more incredible years after that comment. The internet had just become an asset available to everyone, the U.S. government had a budget surplus, and investors were eagerly seeking risky investments. Of course, that led to the “dot-com bubble” bursting, which ultimately triggered a severe bear market.

In 2006–2007, we were in a bull market, but the real fever pitch was in real estate, particularly housing. I recall fairly modest clients calling and pulling funds from retirement accounts to buy second and third homes (despite my best advice). Of course, we all know how that ended.

I could name other periods, like the “meme stock” craze in 2021, but the point is clear: people love bull markets.

As for today, yes, we are in a strong bull market—that is undeniable. There are pockets of froth, particularly in parts of the AI trade and some lower-quality speculative growth stocks. This may lead to a bubble in certain sectors (though who defines a bubble?). I suspect there will be some big winners and even larger losers in that space, so proceed with caution. However, in my daily conversations with clients, golf buddies, etc., I hear skepticism, fear, and downright disbelief. Some of this may be politically driven, but that doesn’t account for all of it. Just this week on CNBC, I saw two well-known hedge fund managers expressing caution. Most commentators I hear are suggesting the market has gone “too far, too fast.” I can’t help but wonder why so few trust this remarkably strong market. I could speculate, but that isn’t important.

The key point is that bull markets don’t end on skepticism and distrust. They don’t end when people predict their demise. They end with wild speculation and euphoria. While there’s certainly some of that out there, the investing public remains, on average, very cautious. That gives me hope that this bull market can continue for a while.

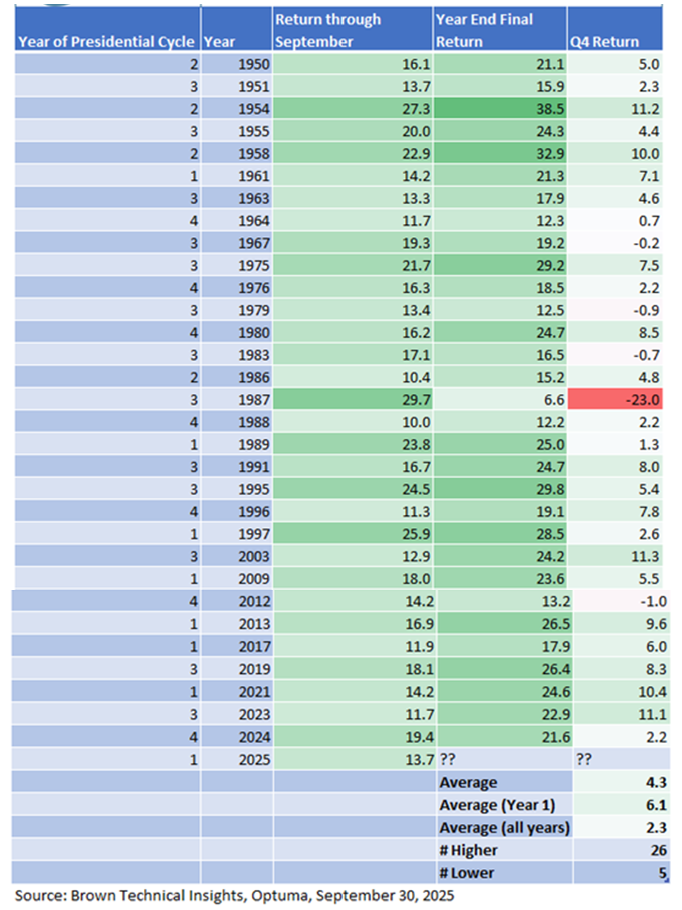

Ultimately, I rely on data. All this talk of feelings is just that—emotions. Emotions are not a reliable investment guide. So, let’s turn to the data. Below is the data for all years when the S&P 500 entered the fourth quarter up 10% or more (we’re up more than 13% year-to-date through Q3).

The great news is that the average gain in Q4 (when entering up 10% or more) is 4.3%, and the market is positive 84% of the time. Even better, in the first year of a presidential cycle, that gain has averaged 6.1%.

Keep in mind that I’ve noted in recent blogs to expect volatility in August and September because they are historically challenging months. By no means is this a guarantee. As I’ve said many times, successful investing is about probabilities, not certainties. Nothing in life is certain. But when you have data that suggests the probabilities are in your favor, you need to pay attention.

The way I see it, we are heading into the strongest quarter of the year, and the results so far this year only increase the odds of higher returns. Coupled with widespread skepticism and naysayers calling this a bubble, I’d say we’re in a favorable position. Again, there are no certainties, but I like those odds.

Until next time. Stay invested. Ignore noise. Focus on the data and probabilities. We’ll see what happens in the next few months…

Past performance is no guarantee of future results. For illustrative purposes only and not indicative of any actual investment. The S&P 500 Index is an unmanaged index of 500 companies used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. These returns were the result of certain market factors and events which may not be repeated in the future. The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. Tracking: 808495-01-01