Well, in a blink of an eye, August has arrived, and for many of us, the kiddos are already back in school. Most of our favorite college football teams will have a game before the end of the month, and fall will be knocking on the door.

As such, August is somewhat of a gateway month into the fall season, which I absolutely love. UGA football, cooler weather, Halloween, etc., are just things that I look forward to every year. But, as sure as August ushers in fall, it also tends to come with a lot of stock market volatility. And, right on cue, we had a very volatile session on Friday, August 1st, with US markets declining roughly 1.5–2.0% on average, which was the worst day we’ve had in a minute.

There are plenty of “reasons” given for the volatility on Friday (jobs numbers, earnings reports, Trump tweets, etc.), but in reality, it’s just that time of year. Let everyone else play the blame game. I want you to just expect the volatility, and, where possible, you should buy it (subject to your time horizon, investment plan, etc., etc., etc.).

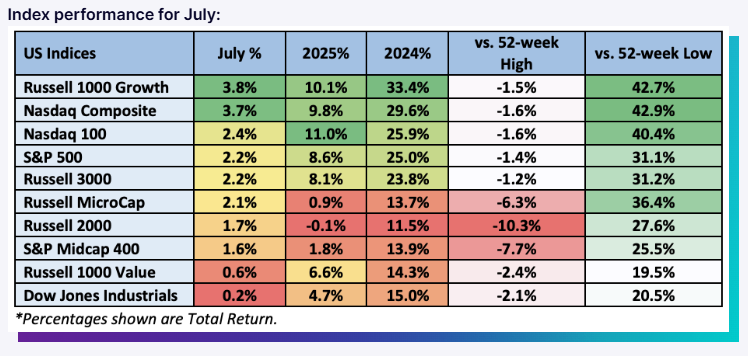

In my last blog on July 2nd, I pointed out that July is seasonally one of the strongest months of the year in the 1st term of the Presidential cycle.

Justin’s Market Musings I Are All-Time Highs SCARY? I July 2, 2025

And, it didn’t disappoint, with the S&P 500 returning 2.2% for the month.

However, I also mentioned in that post that the months of August and September are two of the worst months of the year (per the same cycle data). And, here we are. While using historical trends to try to time the market or predict every twist and turn is a bad idea, we have to respect the data that we have. And, again, it suggests that it is time to be cautious. Let’s face it, the returns over the last couple of months have been incredible. It’s a perfectly logical time for the market to take a little breather…

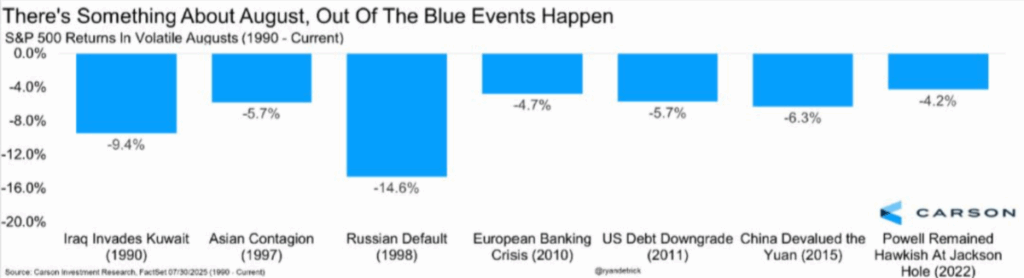

EXCEPT, it is just never that easy. Not only does August tend to start a weak stretch of the year, it often comes with major events that bring a lot of volatility. See the info below from Ryan Detrick at Carson Investment Research. These are great examples of rotten returns in August, arguably triggered by major global events.

That being said, if we can look out further than the next 6–8 weeks, virtually every other trend in historical data points to more gains for markets in the next 6–12 months (including October, November, and December being very strong months). So, yes – I expect volatility. I’d be cautious about investing a huge lump sum of money into markets at this very moment. There’s even a chance we may see the “scary headlines” start coming out sometime in the next few weeks predicting some major economic disaster or something (trust me, “they” are just waiting for their chance to sound the alarm). Don’t be surprised. Expect it.

But, I’ll be using that opportunity to invest for the opportunities that lay ahead. If you aren’t sure why I say that, please go back and look at every blog I’ve put out since early April and you’ll see why we think more gains are in store. We just need to be patient here.

Otherwise, enjoy the cooler weather that we’ve had here recently. It’ll be hotter than blazes again soon I’m sure. We’ll be here if you need us, when you need us.

Until next time…

Past performance is no guarantee of future results. For illustrative purposes only and not indicative of any actual investment. The S&P 500 Index is an unmanaged index of 500 companies used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. These returns were the result of certain market factors and events which may not be repeated in the future. The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. Tracking: 778799-01-01