…And just like that, May is over and summer is officially here. It seems like just yesterday (or perhaps last month) that markets were getting rocked, investors were rightfully nervous, and the financial and news media were shoving economic and market warnings down our throats at every opportunity. To be fair, they may ultimately prove to be correct. But that’s also a game that “permabears” — investment strategists and economists who are always negative — like to play. Eventually, bad markets and recessions do happen. And when they finally do, the permabears claim they were “right, just too early.” In other words, if you keep calling for a recession, you’ll eventually be right.

The longer I’m in this business (July 1 will mark my 27th anniversary… yikes!), the more I realize that trying to predict the market is just futile. S&P 500 year-end targets, recession calls (which we can only confirm after we’ve been in a recession for two quarters), and other worthless guesses are simply ways for Wall Street firms to garner attention. Let’s be honest. If they get it wrong, no one really cares. But if they get it right, they’ll use it for marketing purposes for a decade. Don’t get me wrong, I have my hunches, and I’ll share them when I feel it’s important. But one thing I know for sure: the market goes up over time. A lot. If you have time to be patient, historically, you’ve been rewarded handsomely.

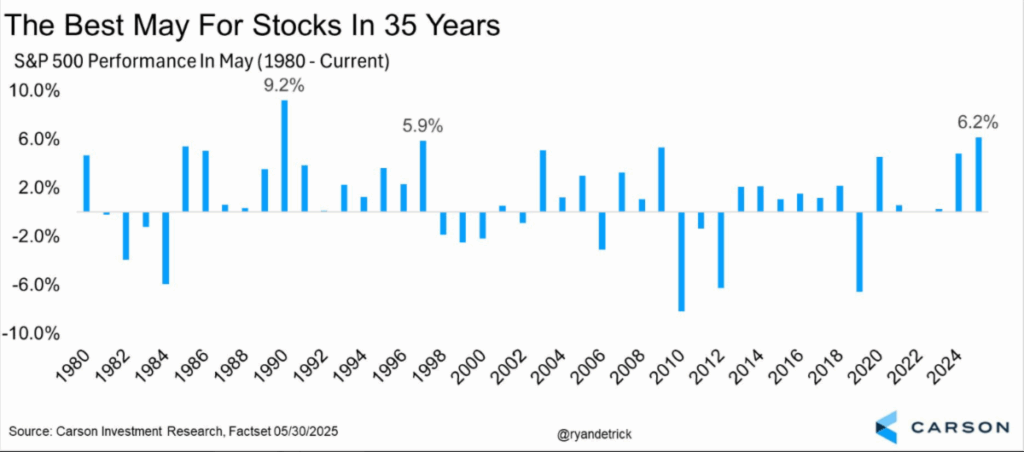

So, back to today’s topic. After all the craziness we saw in April, we just experienced the best May for the S&P 500 in 35 years. Yep, you heard that right. The 6.2% return for the S&P 500 in May was the best since a 9.2% return in May of 1990….And just like that, May is over and summer is officially here. It seems like just yesterday (or perhaps last month) that markets were getting rocked, investors were rightfully nervous, and the financial and news media were shoving economic and market warnings down our throats at every opportunity. To be fair, they may ultimately prove to be correct. But that’s also a game that “permabears” — investment strategists and economists who are always negative — like to play. Eventually, bad markets and recessions do happen. And when they finally do, the permabears claim they were “right, just too early.” In other words, if you keep calling for a recession, you’ll eventually be right.

Unfortunately, for many investors who heeded the warnings from the talking heads on CNBC (or Bloomberg, or WSJ…pick your poison) in April and went to cash, they missed out on a historic market gain. And while I can’t say I expected that kind of rally, at least not so soon after the April swoon, we certainly discouraged our more anxious clients from making any rash decisions, like “moving to the sidelines.” Additionally, we suggested that above-average returns were likely going forward as a result (check our April and May blogs). Obviously, I’m not going to predict anything for the rest of the year, but the probabilities continue to support higher markets over the next 6 to 12 months.

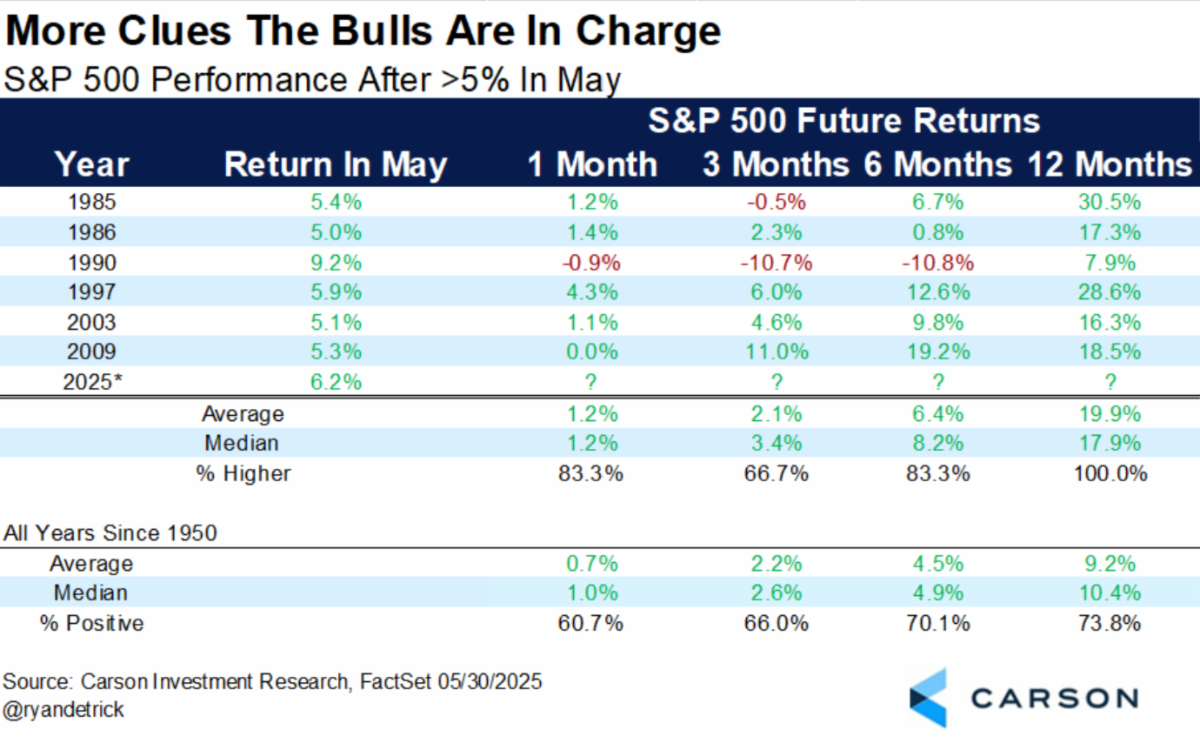

In fact, while this is a limited data set, we’ve now seen seven instances where the S&P 500 gained 5% or more in May. The last six times this occurred, the market was higher one year later every single time, with a median return of 17.9%. Will we go 7 for 7? Only time will tell, but I know where I’d place my bet.

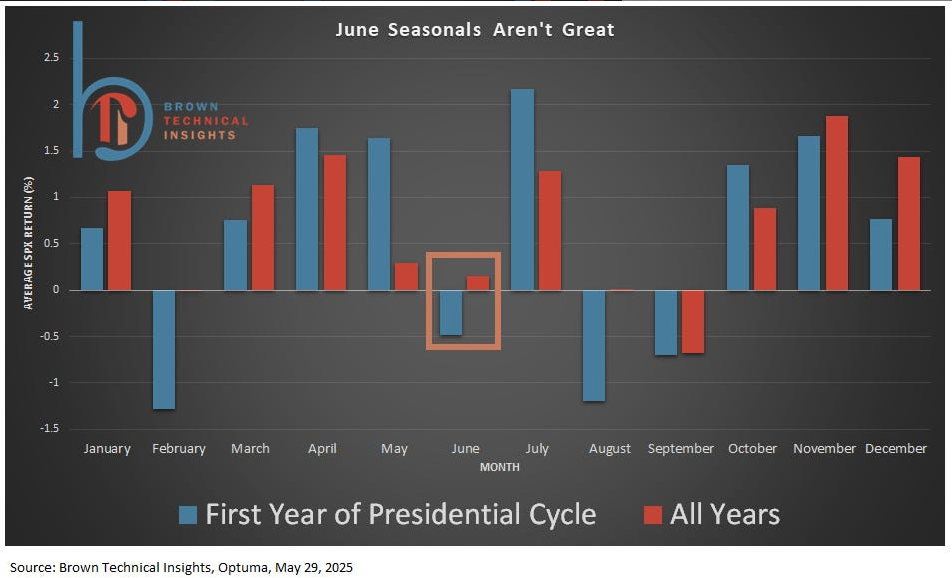

Now, with all that being said, it would be perfectly normal, and expected, for the market to take a bit of a breather in June after the rally over the last six weeks. Trust me, as fun as it is to see accounts going up regularly, that kind of pace isn’t healthy in the long run. We need cooling-off periods to reset valuations and expectations. From a seasonal standpoint, June is actually one of the weakest months in the first year of the presidential cycle. I’d continue to respect that trend. And no, I don’t anticipate making big changes to try to take advantage of (perhaps) some selling pressure in June. Why? Well, as I’ve said 100 times, you can’t time this stuff. But more importantly, July is the best month of the year historically (see below).

(Thanks to Ryan Detrick of Carson Investment Research and Scott Brown of Brown Technical Insights for the incredible data.)

So, just remember, June may be fairly weak and volatile. Expect it. But also, be prepared for all of the scary headlines and dire predictions that the media is going to throw at you during that time. Trust me, they will not miss the opportunity to try to scare the heck out of you when they get the chance. But July tends to be a really good month, and I’d still respect the probabilities that markets will be higher 6 and 12 months out. That’s really what matters.

Lastly, wishing all of you Dads out there an early Happy Father’s Day. Hope we all get to spend some wonderful time with our families (and/or doing Dad things).

Until next time…

Past performance is no guarantee of future results. For illustrative purposes only and not indicative of any actual investment. The S&P 500 Index is an unmanaged index of 500 companies used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. These returns were the result of certain market factors and events which may not be repeated in the future. The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. Tracking #749063-01-01