Happy New Year everyone! I hope your holidays were meaningful and (somewhat) relaxing. I always find year-end is a great opportunity to recharge for the upcoming year. And, after coming off another darn good year in the market(s), I think it is realistic to believe your portfolio will need a recharge in 2026. That’s nothing to be scared of. In fact, I’d rather see a flat to slightly down year in markets instead of another double-digit gain. No, I’m not insane, but I do understand how investor sentiment affects market cycles. And, without a “pause that refreshes,” this market does run the risk of overheating, which never ends well.

To be clear, markets don’t really care about a calendar. So, what happens over the course of a full year is foolish to predict. But there are some things I’d expect to see in 2026, and I think it is helpful to prepare clients (and our team) for certain trends and risks to be aware of.

So, here are my top 3 thoughts on 2026 (or even the next 6-12 months):

- Markets aren’t cheap. We have to start there. This doesn’t mean the market has to crash, BUT it does mean that forward return expectations have to be moderated. We simply can’t expect the same returns in the next three years that we’ve seen in the last three years, at least at the major market index level (i.e., the S&P, Dow, Nasdaq, etc.).

- To be clear, markets also aren’t that expensive. Don’t listen to the rampant “bubble” talk that is constantly in the media.

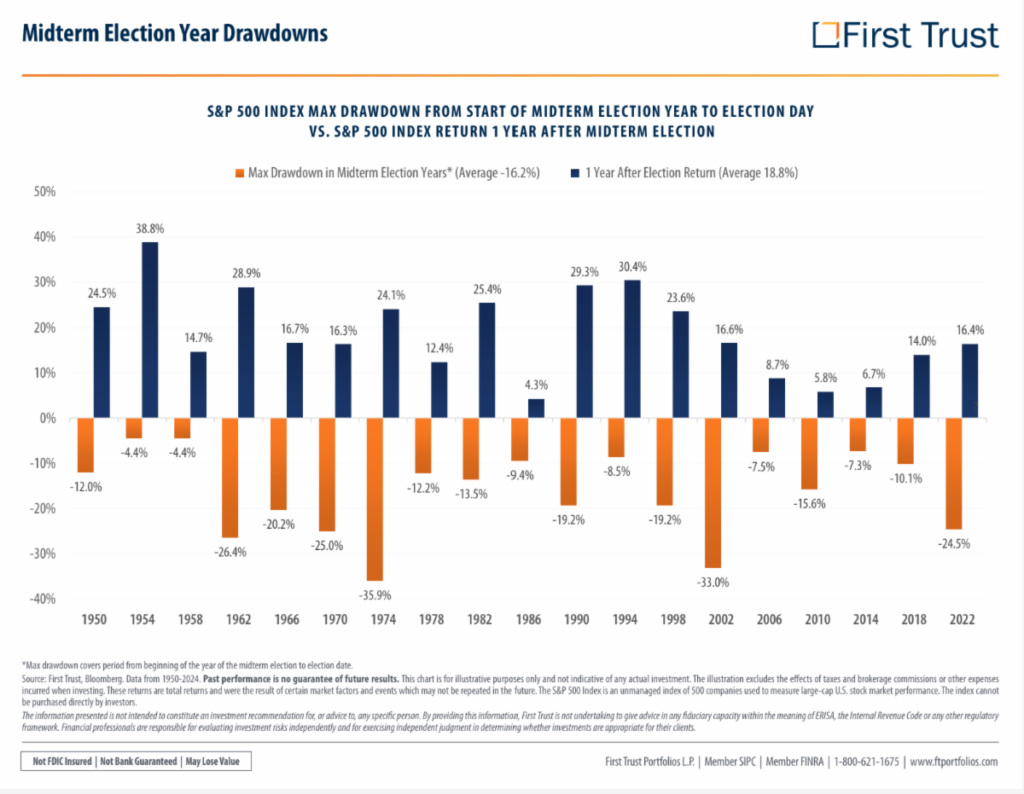

- Mid-term election years just typically are pretty weak. Market cycles and seasonality are a powerful force for a lot of reasons that I won’t get into now. The best way to think about this mid-term election year phenomenon is just that there will be a lot of uncertainty heading into the November elections. Regardless of which team you pull for, it will be hard to know what policy directions will take the lead heading into 2027. We’ll likely see some shakeups in Washington, and we’ll have to reset our fiscal and monetary policy expectations as a result. Expect volatility around this type of uncertainty.

- Lastly, this is just a great reminder that markets are volatile EVERY year. Remember the “liberation day” (tariff) sell-off in April of 2025? While the cause of the volatility may “seem” to be different every year, in reality it is just part of markets every year. But mid-term years are the most volatile of the four-year election cycle. Here’s a great piece from our partners at First Trust showing just how volatile mid-term years can be:

This just shows the average “drawdown” in the S&P 500 in mid-term years is 16.2%. Yes, you heard that right. On average, we have a 16.2% pullback in markets during these years. Why should we expect any different in 2026? But the good news, which is also shown here: one year after the election, we are up an average of 18.8%. So, who knows exactly how this year plays out? No one. But we should expect more volatility than we’ve been used to in recent years, and I think we should expect a tougher year overall for markets.

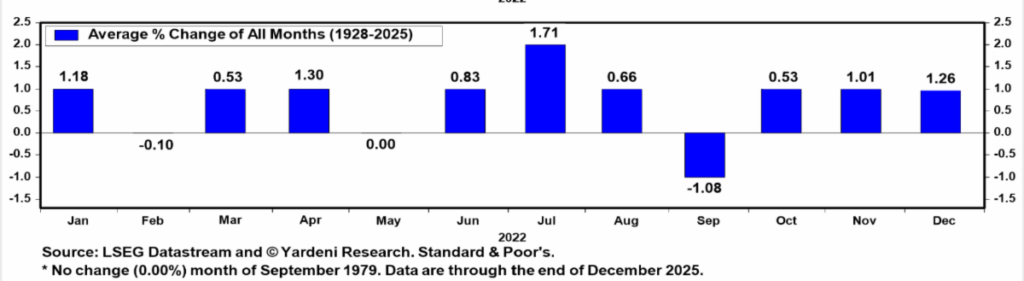

Speaking of weakness, this is a GREAT opportunity to remind everyone that February is typically a weak month for markets. In fact, on average, it is the second-weakest month of the year, behind only September. Again, why should we expect a different outcome this year?

In summary, I think this is just a good time to reset expectations for near-term market returns. There are a few things working against investors in 2026, particularly in the first half of the year. There are no guarantees, so don’t try to time these trends. It doesn’t work. But just be mentally prepared for some rotten stretches this year, and when we get them, don’t react, except to potentially get some additional money put to work. Remember: buy low, sell higher.

We’ll see how things shake out in due time. I’ll comment on anything I feel is important to discuss. Until next time…

Happy 2026!

Past performance is no guarantee of future results. For illustrative purposes only and not indicative of any actual investment. The S&P 500 Index is an unmanaged index of 500 companies used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. These returns were the result of certain market factors and events which may not be repeated in the future. The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. Tracking: 850993-01-02