There’s an old saying that goes something like “May you live in interesting times.” If true, consider us all fortunate because the last few weeks have certainly been remarkable. Of course, we’ve had the political happenings with both the attempted assassination of candidate Trump and Biden bowing out of the upcoming election. But, throw in the major technology disruption that we had last Friday (we were only mildly affected by the way) and the fact that the stock market has just continued to set new record highs, and we have had quite the potentially potent cocktail of events. If you’d have told me back in January that all of these things had happened so far in 2024, I would have doubted that the market would be able to withstand it. Glad I wasn’t given that opportunity!

There’s an old saying that goes something like “May you live in interesting times.” If true, consider us all fortunate because the last few weeks have certainly been remarkable. Of course, we’ve had the political happenings with both the attempted assassination of candidate Trump and Biden bowing out of the upcoming election. But, throw in the major technology disruption that we had last Friday (we were only mildly affected by the way) and the fact that the stock market has just continued to set new record highs, and we have had quite the potentially potent cocktail of events. If you’d have told me back in January that all of these things had happened so far in 2024, I would have doubted that the market would be able to withstand it. Glad I wasn’t given that opportunity!

So, in my last blog back in May, I suggested that we should all ignore the old “sell in May and go away” conventional wisdom (see blog here: https://lineawealth.com/justins-market-musings-sell-in-may-may-01-2024). As luck would have it, that turned out to be the correct call, but even I must admit that the resilience of this market has really been surprising and impressive. Just goes to show that “time in the market” is much more important than “timing the market.”

We did experience a little weakness at the Index level last week (worst week since April), which wasn’t entirely unexpected – let’s face it, the market has to cool off periodically – but conditions continue to support higher markets, certainly over the next 6-12 months. And, while you can probably bet on some volatility during the historically weak months of September and October, we are still pretty optimistic going forward. Of course, we’ll continue to have normal corrections along the way, but that’s just part of being a long-term investor.

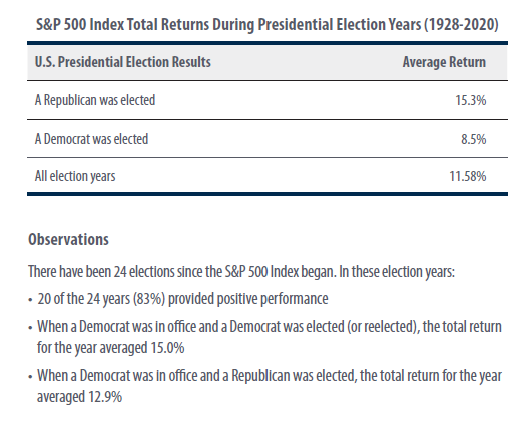

Lastly, I have been getting a LOT of questions/concerns about the upcoming election(s), so I wanted to address the topic at least briefly here. To be clear, any weakness we MAY see in September and October are a seasonality effect and won’t necessarily be tied to election concerns (although that is always a possibility). As it relates to this November, at the moment, we can’t even say for sure who is going to be running. So, I’ll just avoid that topic for now. However, what we do know is that in reality, elections just don’t have a significant impact on the direction of our asset markets. Our financial partners over at First Trust provided this fantastic information regarding markets during election years:

Here’s the takeaway: Despite many investors citing “election concerns” as reasons to avoid/delay buying stocks, the data shows that the market averages 11.58% return during election years and have been positive 83% of the time. Those figures are both ABOVE the historical averages and hardly anything to be overly concerned about. We’ve included the entire piece from First Trust if you’d like some additional stats/perspective surrounding elections and their historical impact.

Here’s the takeaway: Despite many investors citing “election concerns” as reasons to avoid/delay buying stocks, the data shows that the market averages 11.58% return during election years and have been positive 83% of the time. Those figures are both ABOVE the historical averages and hardly anything to be overly concerned about. We’ve included the entire piece from First Trust if you’d like some additional stats/perspective surrounding elections and their historical impact.

Of course, surprises can happen at any time along the way. And, we’d expect a normal amount of volatility between now and November, but we’d use any pullbacks in asset prices as a great long-term opportunity. So, stick to your plan and keep investing, assuming your time horizon is long-term. Before you know it, we’ll move on to talking about how important the 2026 Mid-terms are going to be (isn’t it odd that EVERY election we’ve had is the “most important” one ever?)!

Until next time…enjoy your last month of summer!

Past performance is no guarantee of future results. For illustrative purposes only and not indicative of any actual investment. The S&P 500 Index is an unmanaged index of 500 companies used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. These returns were the result of certain market factors and events which may not be repeated in the future. The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. Tracking #606237