I wanted to share a quick note since we put out a blog a couple of weeks ago suggesting that we still believe a recession is in the cards 6-12 months out. Investors (and Advisors) have become hyper-focused on the “R word” and when they are coming (or not). Frankly, I think we are all worrying about the wrong thing. Can recessions lead to bear markets? You betcha. Some, if coupled with another type of economic/monetary crisis can even lead to BIG declines (see 2000-2002 & 2008). Of course, we want to try to avoid those BIG draw downs if possible (although, often it is not). But, many recessions can come and go without a calamitous effect on asset markets. By the way, don’t forget we had a pretty good (and by good, I mean bad) bear market in 2022. Perhaps it priced in a recession too early? That is certainly a possibility.

I wanted to share a quick note since we put out a blog a couple of weeks ago suggesting that we still believe a recession is in the cards 6-12 months out. Investors (and Advisors) have become hyper-focused on the “R word” and when they are coming (or not). Frankly, I think we are all worrying about the wrong thing. Can recessions lead to bear markets? You betcha. Some, if coupled with another type of economic/monetary crisis can even lead to BIG declines (see 2000-2002 & 2008). Of course, we want to try to avoid those BIG draw downs if possible (although, often it is not). But, many recessions can come and go without a calamitous effect on asset markets. By the way, don’t forget we had a pretty good (and by good, I mean bad) bear market in 2022. Perhaps it priced in a recession too early? That is certainly a possibility.

Along those lines, economic news and data coming out of Germany (Europe’s largest economy) really illustrate my point. We learned in early 2023 that Germany officially entered into recession after their Q1 GDP contracted, making that 2 consecutive quarters (thus a technical recession). We also just learned this week that they just exited a recession after Q2 showed a slight improvement. So, Germany had a 2 quarter recession, at least as the data tells us. Here’s a quick read on this topic:

https://www.conference-board.org/blog/global-economy/Germany-GDP-forecast-recession

But, the point of my comments today is that the German stock market (commonly called the DAX) has done pretty darn well this year. In fact, the German Index is up over 14% year-to-date in 2023. That’s not too shabby, especially during a recession. Here’s a link for reference: https://money.cnn.com/data/world_markets/dax.

So, to say the least, not all recessions are created equally. Not all recessions have a major impact on asset prices. Focus on the long-term and ignore the noise that is always the loudest when elections are coming into focus. We are not significantly concerned with a potential recession looming on the horizon, and in large part that is b/c with interest rates at 20+ year highs, the more conservative parts of your portfolio should hold up quite well. That was not the case during the 2022 bear market.

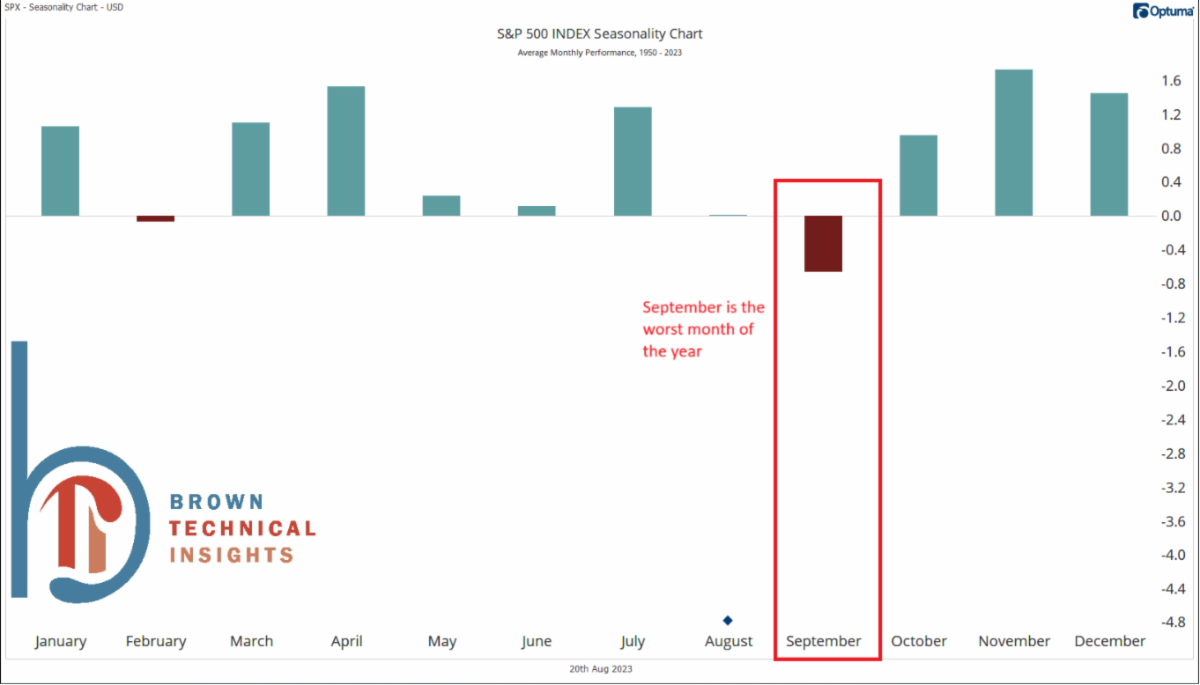

Stay tuned. And, don’t be surprised by further market weakness into September as historically, it is the worst month of the year for the stock market:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. Economic forecasts set forth may not develop as predicted. Tracking # 472284-2