Well, I can tell based on the # of calls/messages that many clients and investors alike are getting very nervous about markets. I totally understand that. With markets having declined 5-7% over the last few weeks, coupled with a lot of headlines coming from Washington and overseas, it is easy to understand that nervousness is rising. Frankly, that is what is SUPPOSED to happen during bouts of market volatility, so what you may be feeling is normal. But, we also need to understand that this phenomenon is what makes investing very difficult, at least if you are trying to time the market. Emotion is the mortal enemy of a sound investment plan.

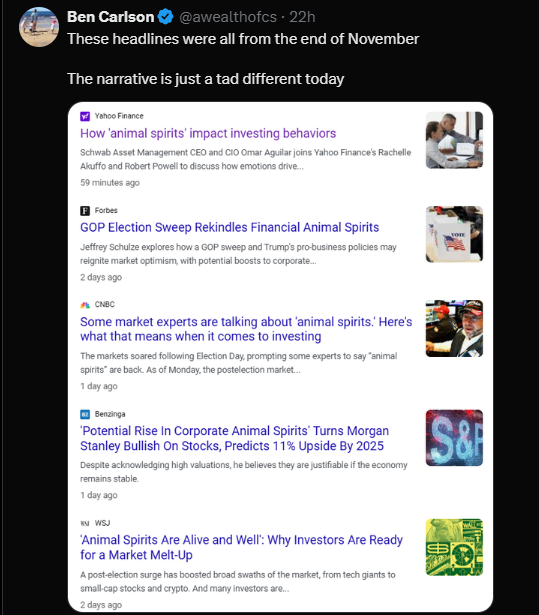

Here’s what I mean. Check out these headlines from back in November, shortly after the elections. They point to “optimism,” “animal spirits”, market “melt-ups”, etc. The average investor typically starts feeling good as a result, forgets their investment plan and chases hot stocks. FOMO is a powerful driver. To be clear, these aren’t “right wing” organizations (that perhaps would cheer the Trump election victory). Yahoo, Forbes, CNBC and even WSJ are far from being Conservative outlets. However, it should be noted that the market has gone absolutely nowhere since the election. So, at best, had you bought on the election results (or seeing articles like this) you’d be flat.

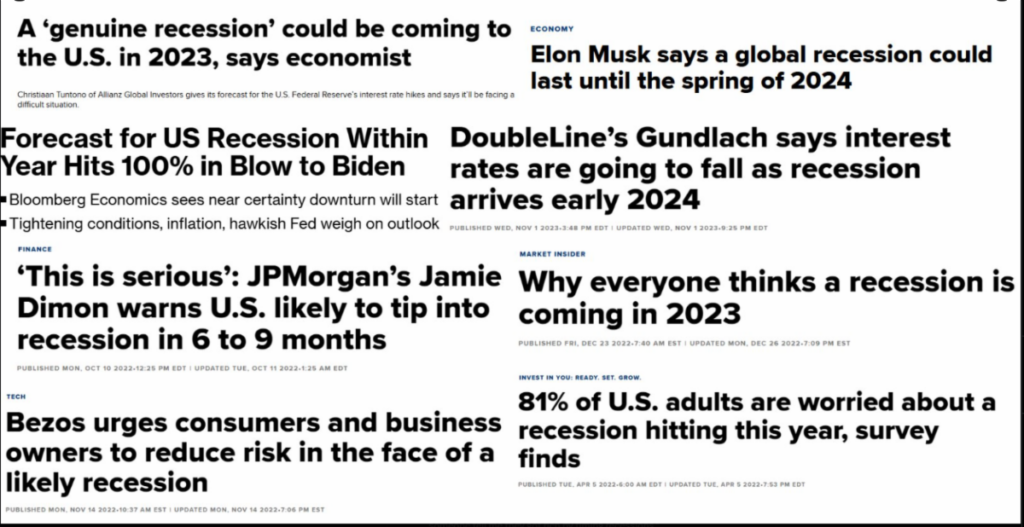

Now, the emotions that are derived from headlines and pundits can go both ways. For example, check out this array of headlines from late 2022 which all but guaranteed a recession was coming in 2023. Anyone reading and listening to these types of predictions largely stayed away from the market and missed 2 incredible years in 2023 and 2024. In full disclosure, we even suggested that a recession was “likely” towards the end of 2023, but at the same time we thought that the impact to the markets would be minimal. Yes, we are equally as bad at market predictions as all of the pundits and talking heads. But, we also weren’t telling clients to sell their investments.

The truth is, NO ONE KNOWS what the economy or the market is going to do. Unless you have a fully functional crystal ball (ours is on the fritz), there is no way to predict the future. And, if you ARE trying to predict the future, at least as it relates to markets/economy, there is a strong chance that headlines (like the ones above) and/or personal bias are going to affect your decision-making. These are just some of the reasons that we know that market timing not only doesn’t work, but likely has a negative impact on your long-term results. That’s why having a plan, and remaining disciplined is the best course of action.

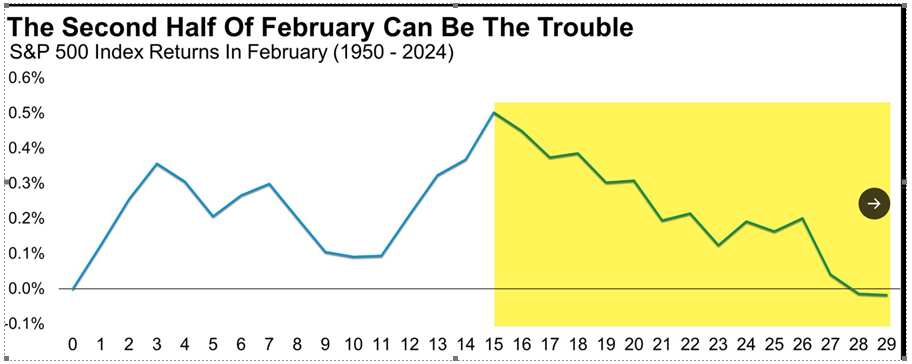

So, what is going on? It would be easy to suggest that the recent market weakness is as a result of all of the headlines of late (Tariffs, Ukraine, DOGE, Immigration), and perhaps some of it is. I’d suggest that these were somewhat known to be goals of the Trump Administration, so why did it not matter until 2 weeks ago? Well, let me offer this interesting bit of info which also may help explain some of the weakness (remember, we also hit an all-time high just a couple of weeks ago).

In reality, the back-half of February is historically weak. In fact, that weakness typically extends into the middle of March. So, the S&P 500 hit an ALL-TIME high on Feb 19th, and then has corrected a decent amount since. Is it a coincidence that it looks very similar to historical averages? Or, is this b/c of the news headlines that we’ve been inundated with during that stretch? Hard to say exactly, maybe a little of both. But, the trends are hard to ignore.

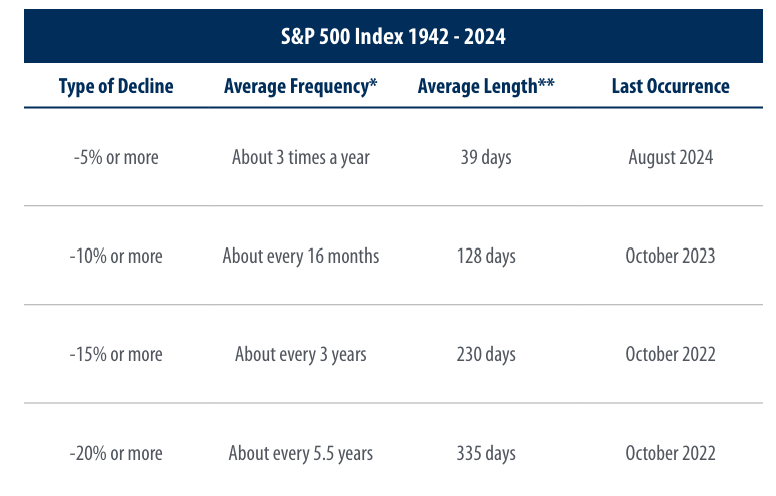

Lastly (and I know this is a longer blog post, but I think this is important so I want to share as quickly as possible), the market is/was overdue for a 10% “correction.” Thanks to our partners at First Trust for this information below:

What this tells us is that markets “correct” (10% or more) about every 16 months on average (since 1942). The last correction we had was October of 2023….which was 17 months ago. Hmmm…

So, yes, the market is unsettled b/c the market likes CERTAINTY. One thing is for sure, the current headlines have created some uncertainty. But, markets are historically weak in late February through the middle of March, AND we were due for a 10% correction. And, while I can’t tell you (and no one can) what the next few weeks/months hold, I can tell you that no one can predict it and no one can time it. So, the best bet is to ride it out and try to keep the overall plan in mind.

Past performance is no guarantee of future results. For illustrative purposes only and not indicative of any actual investment. The S&P 500 Index is an unmanaged index of 500 companies used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. These returns were the result of certain market factors and events which may not be repeated in the future. The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. Tracking #705188