Well, in my last blog, I mentioned how excited I was for a weekend of The Masters golf tournament. And, boy, we were not disappointed. It was arguably one of the best finishes in Masters history, and the storyline of Rory McIlroy finally vanquishing the demons and completing the “career slam” was just so dramatic. It was truly one for the ages…

There was another primary theme for that blog as well…the recent historic sell-off that we were in the middle of. To be clear, a 10–20% decline itself isn’t historic, but the speed at which we went from all-time highs in mid-February to an (intra-day) 20% bear market was indeed rare. BUT, speaking of “one for the ages,” the rally from the lows to finish the month virtually even was also remarkably rare. Here are a couple of the incredible stats from the historic rally to finish the month of April.

This is a bit hard to read, but I’ll summarize it:

- This was just the 7th time since 1950 that we’ve been down 10% in a month, and then up more than 10% from the lows in the same month.

- While the near-term isn’t as stark, if we look 12 months later in these previous instances, the market was up 100% of the time—by an average of 22.1%.

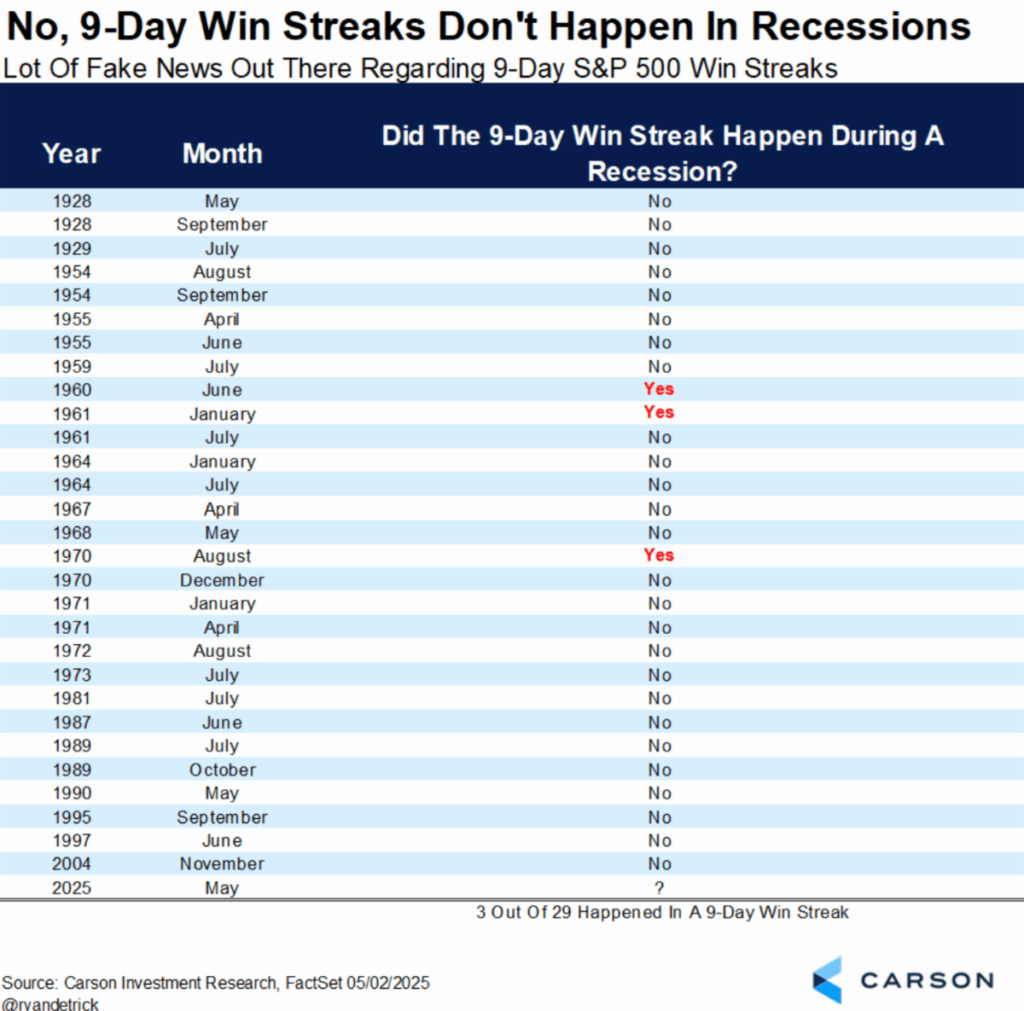

Next, we had a 9-day winning streak in the market to finish off the month (and into early May). Again, incredible. Of course, all we hear about on the news (besides tariffs) is that a recession is inevitable. Actually, it seems we’ve been hearing this for 3–4 years. Anyway, back to the data. Since the origination of the S&P 500 (“the market”) in the 1920s, we’ve only seen a 9-day winning streak 29 times. And while many of these streaks were clustered around volatile periods in markets, only 3 of the 29 (10%) happened during a recession.

(Again, thanks to Ryan Detrick at Carson Investment Research for the data.)

Ok, so what do we do with this information? I’ve said it before, and I’ll say it again: Investing is not about CERTAINTIES; it is about PROBABILITIES. And this data suggests that we have a favorable probability of being higher 6–12 months from now—and with higher-than-average returns. That theme was also expressed in my last blog, which, as I mentioned, was at the depths of the recent sell-off. If you haven’t read that blog, please do so—or even go read it again. There are VERY important takeaways now that we can look back in hindsight (which is always 20/20):

Justin’s Market Musings | Masters Week is Here (oh, and that market crash too)! | April 08, 2025

A few themes from the April blog that I’ll further reiterate here:

- I have no idea what the market is going to do in the next few weeks or months. No one does. But I know for SURE that you can’t time this. April was the perfect example of why we don’t even attempt to do it.

- Markets have bad stretches. It’s part of investing. But those bad stretches tend to lead to big gains in the future. Again, STAY PUT—or buy more if you can.

- Don’t change your long-term plan based on short-term market changes. This goes for both good and bad periods.

In closing, we may certainly slip into a recession, especially if this tariff war doesn’t have some resolution in the next few months. I have no idea. Good luck predicting what’s going to come out of the White House on a daily basis. But the strategy is still the same: Stay cool. Stick to the plan. Make sure your portfolio is allocated correctly for your risk tolerance and time horizon. Invest more if markets fall precipitously. I suspect that whatever happens, we’ll be just fine if we look out a few years (heck, maybe even a few months!).

Speaking of volatility, this market lately reminds me of my golf game! Up/down/up/down. But the key is to stay calm and focus on the process. Speaking of golf, we have ANOTHER “Major” tournament (PGA Championship) next weekend. Don’t be surprised if Rory pulls off another one now that the monkey is off his back.

Until next time… wishing all of the moms a VERY Happy Mother’s Day this weekend!

Hopefully the weather is perfect for your day on Sunday.

Past performance is no guarantee of future results. For illustrative purposes only and not indicative of any actual investment. The S&P 500 Index is an unmanaged index of 500 companies used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. These returns were the result of certain market factors and events which may not be repeated in the future. The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. Tracking: 721978-01-01