It is mind-blowing that we are already into April now. Easter has come and gone and the pollen is in full swing. Speaking of full swing, I can’t wait for the Master’s coverage this weekend! It is the best weekend of the year for golf fans. Let’s hope this beautiful Georgia weather holds out.

The market overall has had a great start to the year. Sure, not everything has gone up, but it is hard to believe that just a year ago, we were recovering from a pretty nasty “bear market.” A nice year + of recovery has made everyone feel a bit better. In fact, we are starting to see some signs that perhaps the investing public is becoming a little too optimistic. This isn’t a warning sign by any means, but just remember that markets generally rise when everyone is pessimistic and fall when everyone is optimistic. Our former Federal Reserve Chairman Alan Greenspan was famous for his concern over “Irrational Exuberance” in the late 90’s. Frankly, I think he was right, but he was too early and the market continued higher for another year or two before the “dot com” bubble began to burst in April of 2000. So, gauging optimism/pessimism readings is an important factor, but they aren’t a timing tool.

Of course, with the election coming up later in the year, I’m guessing that will do plenty to reduce any excess optimism as you can rest assured that roughly half of the country will be disappointed. But, while we are still pretty optimistic about the remainder of the year, we continue to stress that we are OVERDUE for some market weakness. We have enjoyed a really nice stretch since October of 2023, but we typically see declines of 5% or more (in the S&P 500) about 3 times per year (so every 4 months or so, on average). Well, we haven’t seen a 5% decline since Oct of last year. So, we are 6 months + removed from our last period of weakness. Again, while we don’t think there is a need to be overly concerned, we do continue to expect some increased volatility and some short-term declines in the market. History suggests that we will and it is quite normal.*

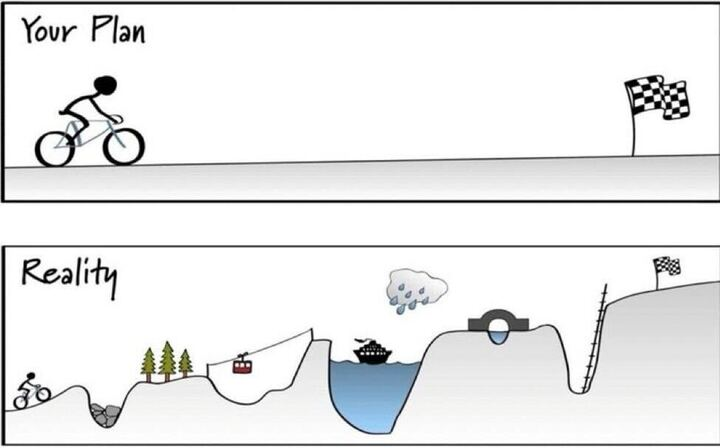

So, as usual, you just have to stick your long-term plan, in good and bad markets. Along those lines, while reading over the weekend, I found this humorous graphic that I thought I’d share. Yes, it is funny, but it is also true. Life rarely goes as planned and neither do your investments, but it is really about the end result. Everything in between is ultimately just experiences and noise.