As recently as 2 weeks ago, markets were hitting all-time highs, employment and economic data were quite rosy and the outlook was (relatively) stable. My how the narrative has changed. Seemingly overnight, we’ve had a major escalation in a potential conflict between Iran and Israel. Japan and other Asian markets have seen historic losses, and we are now seeing the US Market get rocked with headlines suggesting a pending recession. By the way, the US recession calls have come mostly from a slightly disappointing jobs number on Friday. I have a hard time getting too worked up about a volatile economic data point, but nonetheless, the market isn’t liking this sudden onset of concerning headlines.

And, while big sell-offs in the market can be unnerving (trust me, I’m human too), especially when much of it comes in just a few days, I thought this was just a great opportunity to remember that these days often represent a GREAT buying opportunity if your time horizon is long-term. Once again, our friends at First Trust have provided this information in a timely manner so that we could share this will all of you.

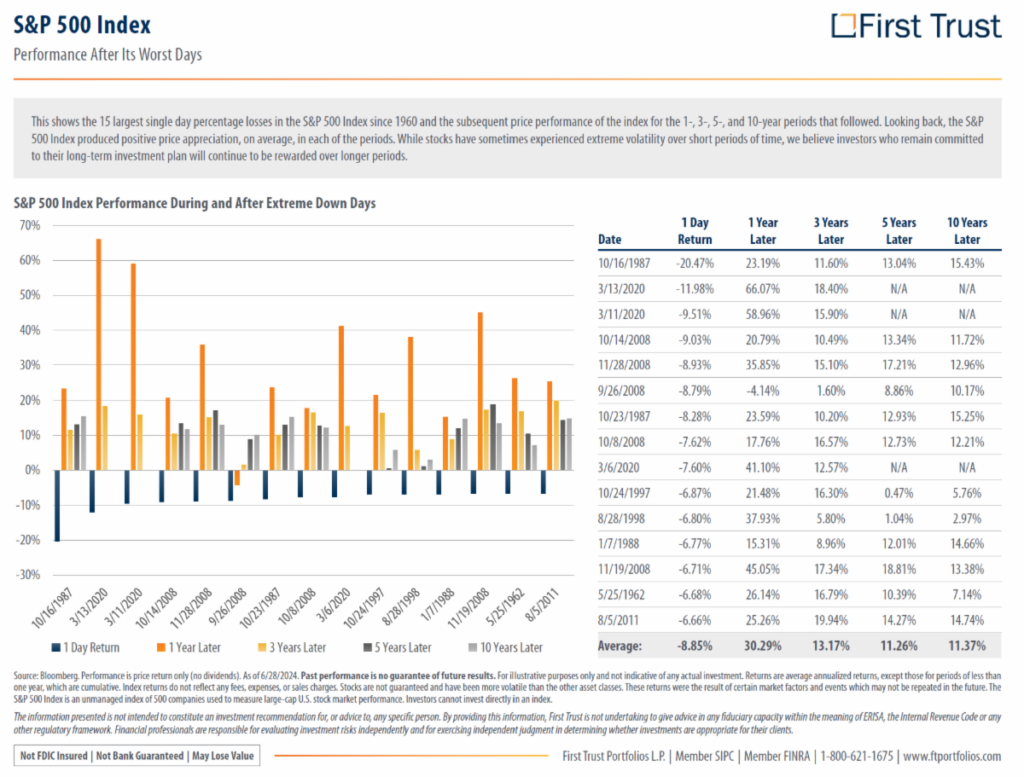

See below for a look at some of the biggest 1 day declines in US market history. For one thing, it is important to see that these things aren’t a regular occurrence, but they do happen more often that most of us remember. Most importantly, note the performance of the market if we look out 1 year, 3 years and 5 years later! On average, after these substantial sell offs, the S&P 500 has gained 30.29% over the following year. That’s pretty impressive.

So, yes – get ready to feel a bit uncomfortable when reading headlines or looking at your daily account balance fluctuations. This is part of investing. But, keep a long-term perspective. If you don’t need the funds now, or in the very near future, this is likely just another data point to be added to a chart that we’ll bring up the next time this happens.

Past performance is no guarantee of future results. For illustrative purposes only and not indicative of any actual investment. The S&P 500 Index is an unmanaged index of 500 companies used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. These returns were the result of certain market factors and events which may not be repeated in the future. The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. Tracking #611519 -2