It is hard to believe we are already in March of 2023! But, since time is going by so quickly, I thought it was a good time to look back at some of our previous blog posts. Why? Well, for one – nothing has changed with our expectations for 2023. But, I also want to reiterate a few important things to remember as we continue to stumble our way through this challenging market and economic environment.

It is hard to believe we are already in March of 2023! But, since time is going by so quickly, I thought it was a good time to look back at some of our previous blog posts. Why? Well, for one – nothing has changed with our expectations for 2023. But, I also want to reiterate a few important things to remember as we continue to stumble our way through this challenging market and economic environment.

1: Don’t try to time the market!! Of course, we want to make smart adjustments over time, but trying to move in-and-out of cash to improve your results simply does not work (see blog post from October 2022: https://lineawealth.com/avoid-the-market-timing-urge-october-21-2022/). And, if you needed any more proof that market timing doesn’t work, look no further than the start of 2023. After the worst year for the S&P 500 since 2008, January 2023 rewarded investors with one of the best January’s on record, with a 6.18% return!

2: We are in one of the strongest periods of the year and of the 4-year Presidential cycle! While historic patterns don’t always work perfectly, it is wise to respect them. In fact, in a September blog post (https://lineawealth.com/patience-is-a-virtue-september-9-2022/) I pointed out that Q4 of 2022, and Q1/Q2 of 2023 were the 3 strongest quarterly periods in the 4-year Presidential Cycle. And, while the script has yet to be written on Q1/Q2 2023, Q4 of 2022 rewarded investors with a 7.08% return for the S&P 500. That’s a heck of a start!

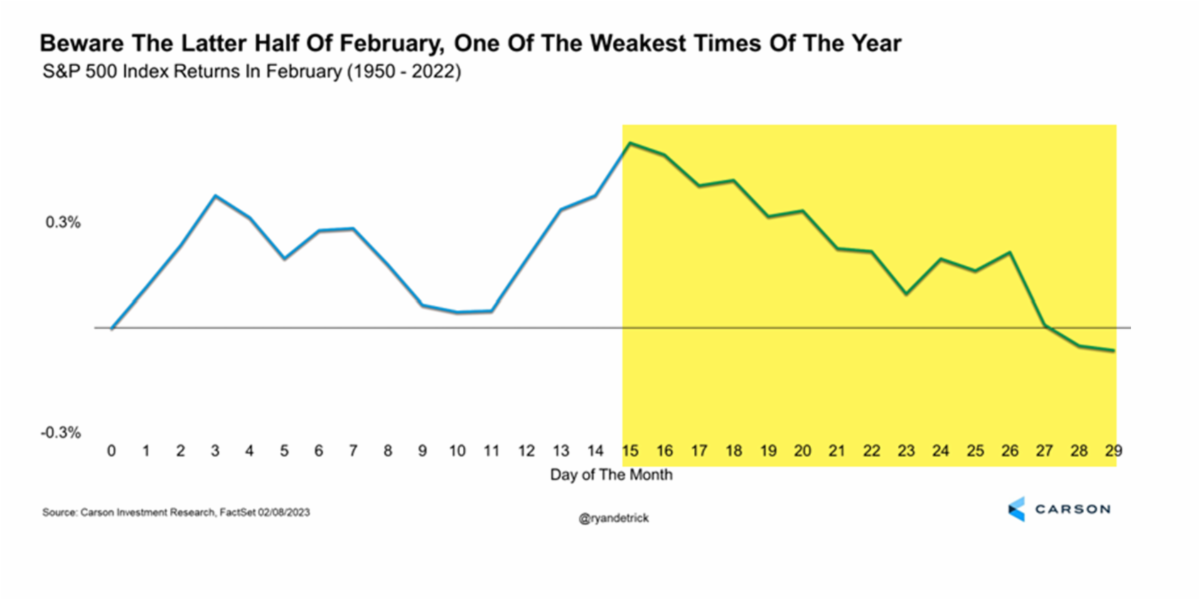

3: Yes – the market was fairly weak in February of this year, with the S&P 500 losing 2.61%. Overall, this shouldn’t be too surprising coming off such a strong January, but if we look closer, we’ll see that historically, February is a weak month. In fact, the 2nd half of February is historically one of the weakest periods of the year. See the graph below from Ryan Detrick of Carson Investment Research. So, again, historic trends continue to prove valuable as a road map. That bodes well for March and April, at least.

So, while we continue to expect 2023 to be a frustrating year with plenty of ups-and-downs, we can’t deny that history is in our favor at the moment. Don’t try to time the market. Focus on your long-term goals. But, we are optimistic about the next couple of months, so perhaps investment portfolios will be warming up along with our weather as we approach Spring!

And lastly, as the GREAT Warren Buffet said: “The stock market is a device for transferring money from the impatient to the patient.”

We couldn’t have said it any better ourselves!

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. Economic forecasts set forth may not develop as predicted. Tracking #415130-1